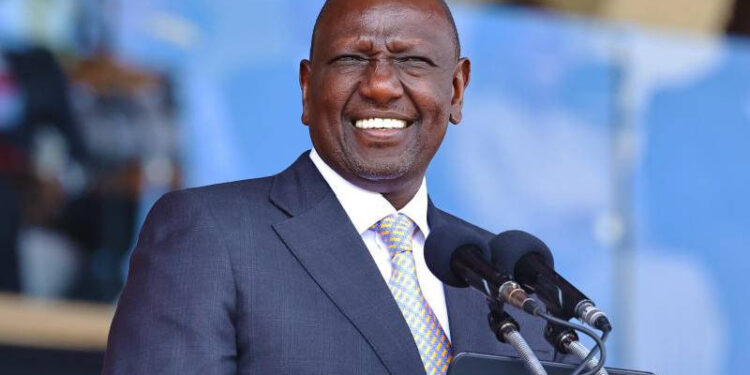

In a significant boost for Zimbabwe’s economic revitalisation efforts, Kenyan President William Ruto has endorsed the country’s newly launched gold-backed currency, ZiG, during an international trade fair in Bulawayo. Ruto’s endorsement comes as Zimbabwe seeks to stabilise its economy and shield its citizens from currency fluctuations and high inflation.

Ruto praised Zimbabwe’s monetary policy, stating, “This radical revitalisation of Zimbabwe’s monetary policy will contribute greatly to the country’s economic resurgence.” He emphasized the importance of utilizing Zimbabwe’s substantial reserves of precious metals, including gold, platinum, silver, copper, and lithium, to back the national currency, ZiG.

Zimbabwe’s gold deposits have historically played a crucial role in the country’s economy, accounting for nearly 25 percent of its total exports as of January 2024. The launch of ZiG aims to leverage these resources to stabilize the economy and protect citizens from economic instability.

Despite some concerns raised by experts about the sustainability of ZiG’s backing, Zimbabwe’s Central Bank governor has reassured that the country will refrain from printing additional ZiG notes unless it has the reserves to back them.

Vice President Constantino Chiwenga highlighted that the introduction of ZiG marks a significant step towards reducing reliance on the US dollar, which is currently legal tender until 2030. The move signals Zimbabwe’s intention to regain control over its monetary policy and reduce dependency on foreign currencies.

The newly introduced ZiG banknotes will be available in denominations of 1, 2, 5, 10, 50, 100, and 200, providing a range of options for consumers and businesses. This diversification of denominations aims to facilitate transactions across various sectors of the economy.

Zimbabwe’s decision to launch ZiG comes amidst efforts to revive its economy, which has faced numerous challenges and pressures in recent years. The country has been grappling with hyperinflation and currency instability, leading to economic hardship for many of its citizens.

The move to introduce a gold-backed currency reflects Zimbabwe’s commitment to harnessing its natural resources for economic development. By pegging ZiG to gold, Zimbabwe aims to instill confidence in its currency and attract investment, both domestically and internationally.

However, the success of ZiG will depend on various factors, including the stability of gold prices and the country’s ability to manage its reserves effectively. Zimbabwe will need to implement prudent fiscal policies and transparent governance practices to ensure the sustainability of ZiG and its long-term economic stability.

Despite the challenges ahead, Zimbabwe’s introduction of ZiG represents a bold step towards economic revitalization and a departure from the country’s troubled economic past. With careful management and strategic planning, ZiG could pave the way for a brighter economic future for Zimbabwe and its people.